FAQ - How to change or add a new VAT rate |

|

This FAQ provides details about how to change or add a VAT rate for a specific country, on any software hosted by DoliCloud. All Open Source software hosted by DoliCloud which manage VAT details are covered here. Check the instructions that match your software version.

Adding a new VAT rate in dictionary

These instructions will work if you are using the Dolibarr ERP & CRM 3.4.2, or a more recent version.

To replace a VAT rate that has changed with a new value:

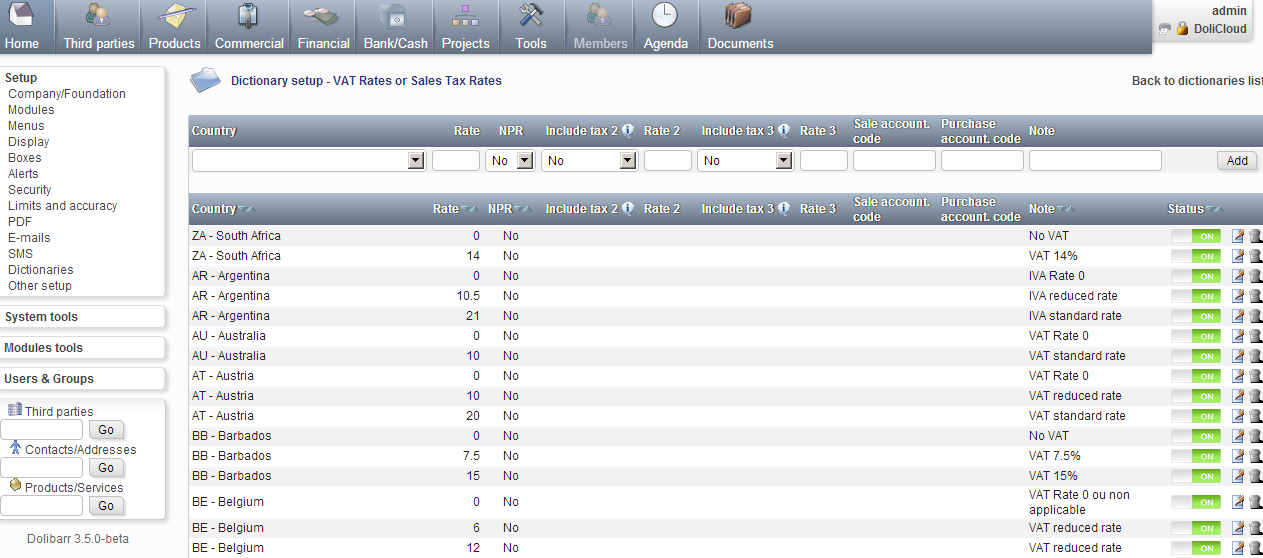

The first step is to add the new VAT rate for your country. - Login to your Dolibarr instance as an admin user. - Navigate to the menu Home - Setup - Dictionary - VAT rates or Sales Taxes - On the first line, choose your Country (first field), enter the new VAT Rate (second field), then a Note (last field, for example "New VAT rate for year 2020") and click on Add.

- Check the list if the VAT rate has been added successfully.

Updating the default VAT rate of all products/services

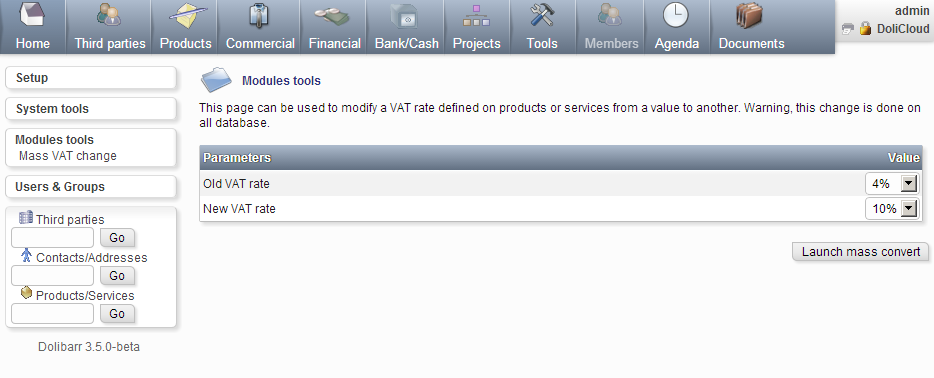

If the module Product or Service is enabled, and you would like to change the VAT rate (that has been defined) as the rate to use for some predefined products. - Navigate to the menu Home - Modules tools - Choose the menu entry Mass VAT change. - You will get a page with two lines:

- Enter in the first line, the value for the old VAT rate. In the second line, enter the value for new VAT rate, then click on the button "Change". Doing this will change all the sale prices of your products and services with the new value. If the reference price of a product or service was set to price without tax, the amount that will be modified will be the price including tax (price without tax remains the same). If the reference price of a product or service was set to price including tax, the amount that will be recalculated and modified will be the price without tax (price including tax remains the same).

FAQ written by the DoliCloud support team. |

Product and Services

Quick links

Legal information

DoliCloud, the Cloud and Open Source solutions for business - Official Dolibarr Preferred Partner - ©Copyright 2011-2025. All rights reserved. Various trademarks held by their respective owners.